uber eats tax calculator uk

If youre a food delivery driver you must have an ABN but you do not have to register for GST. Introducing the tax guide for Grubhub Uber Eats Doordash Instacart and other gig economy contractors.

Why Won T Deliveroo Refund Me Which News

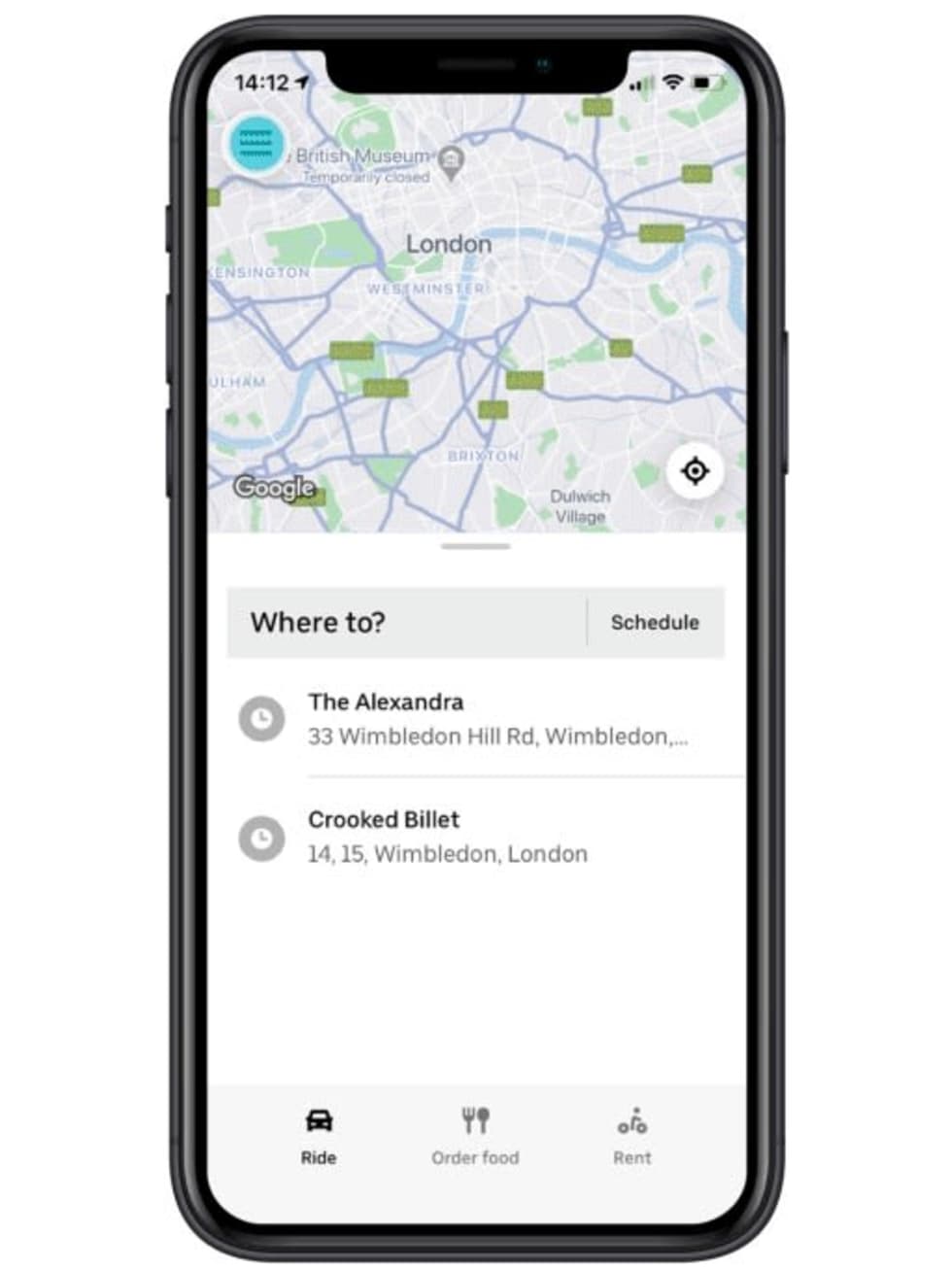

Order food online or in the Uber Eats app and support local restaurants.

. Youll then have to wait a few days for. The 58p VAT Adjustment arises from where Uber charges the customer VAT on the 350 charge for the delivery. Find the best restaurants that deliver.

Your 1099-K is an official IRS tax document that includes a breakdown of your annual on-trip gross earnings. Cost per min. Discussion Starter 1 Jan 27 2019.

If you are responsible to collect sales tax based on this threshold you will need to provide Uber Eats your HSTGST registration number. Ad Follow Our Simple Step-By-Step Process To File Your Rideshare Taxes W Ease. The articles in the 2021 Tax Guide for Gig Economy Contractors.

Create a f ilter. Well send you a 1099-K if. In cities where cash payments are available this option must be selected before you request your ride.

You may have heard that Uber drivers must register for GST but that tax law. How to Calculate Your Tax. The tax on your security job will come out of PAYE.

Youll need to send a self assessment and register as a sole trader with HMRC when this tax. With our tool you can estimate your Uber or Lyft driver taxes by week month quarter or year by configuring the calculator below based on how much and how often you plan to drive. Uber eats tax calculator uk Monday March 14 2022 Edit.

In most cities Uber is designed to be a cashless experience. Filter vie w s. But confused which method will be used for UK hmrc income tax.

There is no VAT on the uber charges which are 30 or gross sales through uber as they are a Dutch BV. Uber Eats the drivers eequirements. Recently Ubers UK head of public policy Andrew Byrne revealed three typical hourly rates.

Home eats uber uk wallpaper. You can log into your Uber profile and input your. TAXOD salary tax calculator does your tax return in its entirety.

Hello i am self employed as an uber driver started last year. Income tax starts at 20 on all your income not just from Uber over 12500 and 40 over 50000. TAXOD is the only mobile tax filing tool that was built by freelancers for freelancers.

How do I get a price. Prices were updated 3 days ago. DEDUCT YOUR BUSINESS EXPENSES.

26 November 2017 at 544PM in Cutting Tax. They refund the VAT back to the merchant for the reasons mentioned above. So r t range.

Youll need to submit your return for tear-ending April 2021 no later than January 2022 and would normally pay the tax that you owe at the same time. S ort sheet. Click on income tax then on the right you should see current income types click manage and add self employment as an income type.

You neednt bother with a higher. It for the most part takes 24-48 hours yet now and then more. Update prices to see the real-time rates with.

Now i have to complete my self assessment tax return and i have a. Enter your data and sit tight for your reaction. I am doing uber eat using my car part time.

All you have to do is set up your tax. The amount of tax and national insurance youll pay will depend on how much money is left over after deducting your Uber expenses tax allowances and reliefs. 9 per hour if youre paying for your car through car finance.

950 per hour if you drive your own car. Get contactless delivery for restaurant takeaways food shopping and more. Once youve tried it out check out our list of 16 Uber driver tax write offs to see how you can save more on your year-end taxes thereby increasing your true profit.

Only show this user. Add a slicer J Pr o tect sheets and ranges. Our invoice states Total Sales 60058 we pay standard VAT of 20.

A l ternating colors. As of 202021 Class 4 is paid at 9 on profits between 9501 and 50000 and at 2 on any profits above 50000. C lear formatting Ctrl.

Uber Boat By Thames Clippers Sail To Work In London

The 14 Best Apps To Track Your Uber And Lyft Mileage

Car Rental Owners Are Making A Strong Application To The Government In Order To Reduce Their Taxes As They Are Paying A Lot Of Ta Car Rental Solutions Finance

The 14 Best Apps To Track Your Uber And Lyft Mileage

Uber Faces Legal Action Over Sharia Compliant Pension Arrangements Ftadviser Com

Driver Pay And Sign Up Requirements For Uber Eats In Kingston Uber Delivery Driver Uberx

Tracking Your Earnings Driver App Uber

How To Calculate Uber Miles For Taxes Taxestalk Net

Do I Owe Taxes Working For Ubereats Net Pay Advance Payday Loans Online Payday Advance

3 Ways To Make More Money Driving For Uber Without Doing Anything Extra Uber Driving Uber Facts Uber Driver

How To File Taxes For Uber As An Independent Contractor Filing Taxes Independent Contractor Uber Driving

21 206 Supplier Photos Free Royalty Free Stock Photos From Dreamstime

Uber Eats Changes Its Delivery Fee Structure

Epic Packing List Packing List Travel Pictures Travel Design

Ubereats Quebec City Pay Rates And Driver Requirements Quebec City Quebec City

Drive For Ubereats In Kitchener Waterloo Waterloo Rustic Farmhouse Kitchen Rustic Farmhouse Kitchen Cabinets